Providing FBR-compliant digital invoicing solutions all over Pakistan.

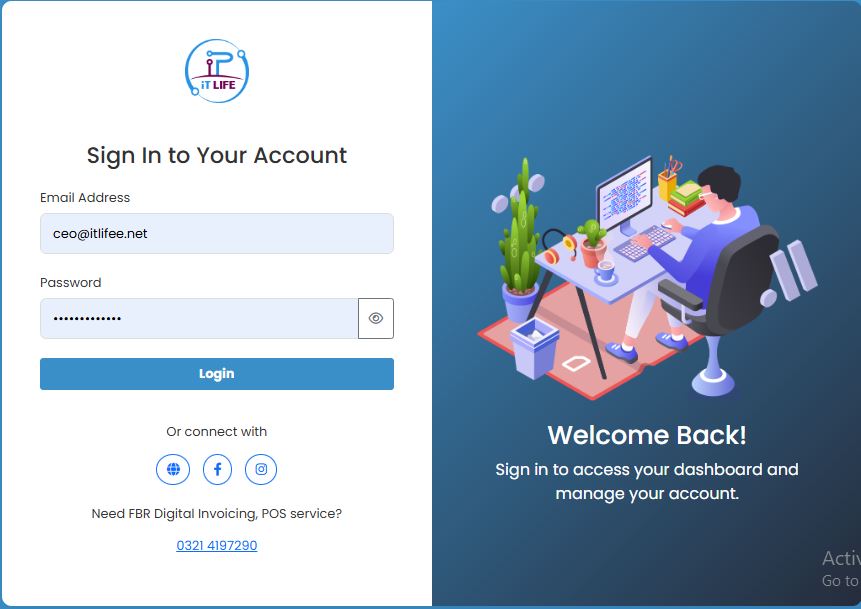

Login NowWe invite experienced tax consultants, chartered accountants, and financial professionals to join us as valued partners in delivering FBR-compliant digital invoicing solutions to your clients across Pakistan.

Automatically transmit invoice data to FBR in real-time for seamless tax compliance.

Digitally signed invoices with unique QR codes and cryptographic security to prevent fraud.

Auto-populated tax fields reduce manual errors.

NTN validation for both parties during invoice creation.

Real-time sales tax reporting for business insights.

Generate invoices from anywhere using Web portal or mobile-responsive platform.

The FBR Digital Invoicing System is fully compliant with Pakistan's Sales Tax Act and Income Tax Ordinance. Our platform ensures you meet all regulatory requirements effortlessly.

Enroll your business with FBR and obtain your unique digital invoicing Sandbox token first Watch Video.

Connect fbr digital invoicing software to iris using token.

How to do? watch video

Generate FBR-approved invoices that automatically report to tax authorities.